USDCAD H1: پیشبینی نظریۀ آشوب برای سِشِن آسیا به تاریخ 1.4.2025

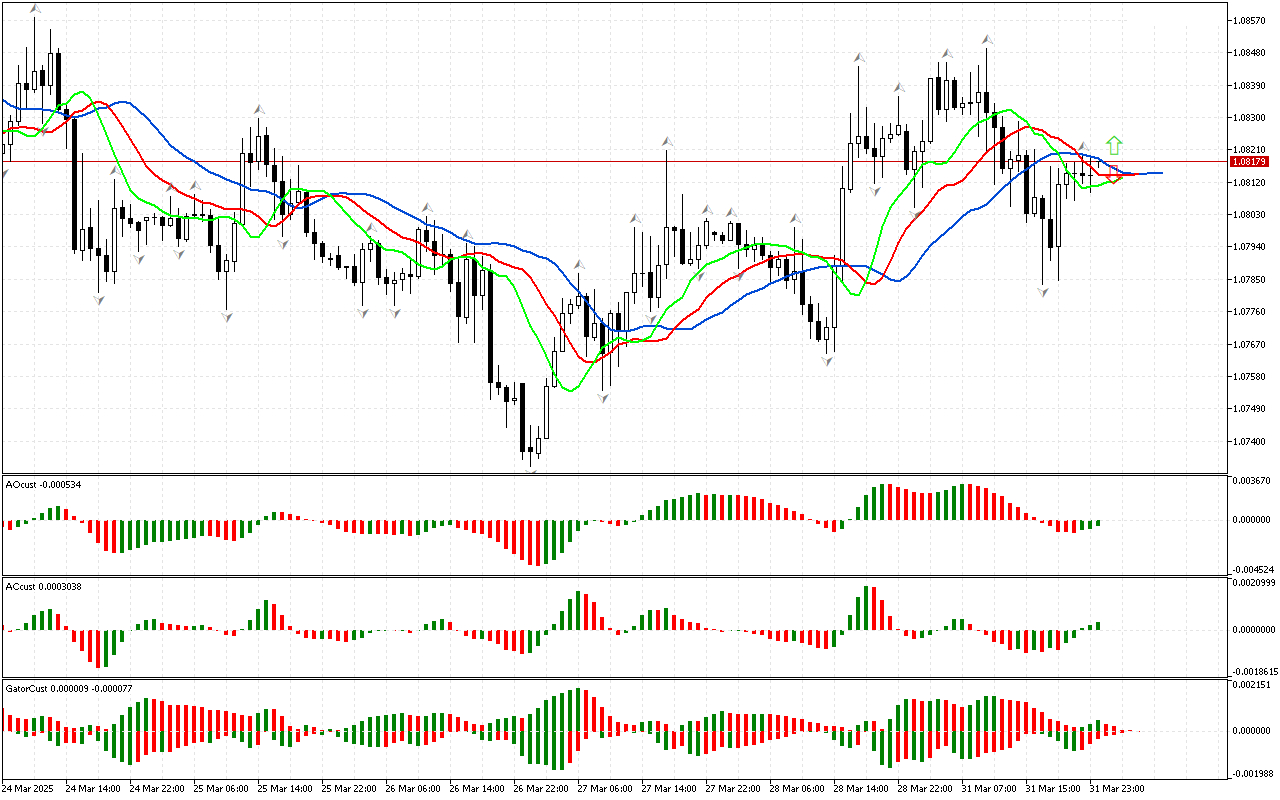

با توجه به نمودار USDCAD، فضای فاز صعودی است، چون قیمت از فراکتال بالایی عبور کرده و اکنون میتوانیم نشانههای سایر ابعاد بازار را در چارچوب استراتژی بیل ویلیامز بررسی...

با توجه به نمودار USDCAD، فضای فاز صعودی است، چون قیمت از فراکتال بالایی عبور کرده و اکنون میتوانیم نشانههای سایر ابعاد بازار را در چارچوب استراتژی بیل ویلیامز بررسی...

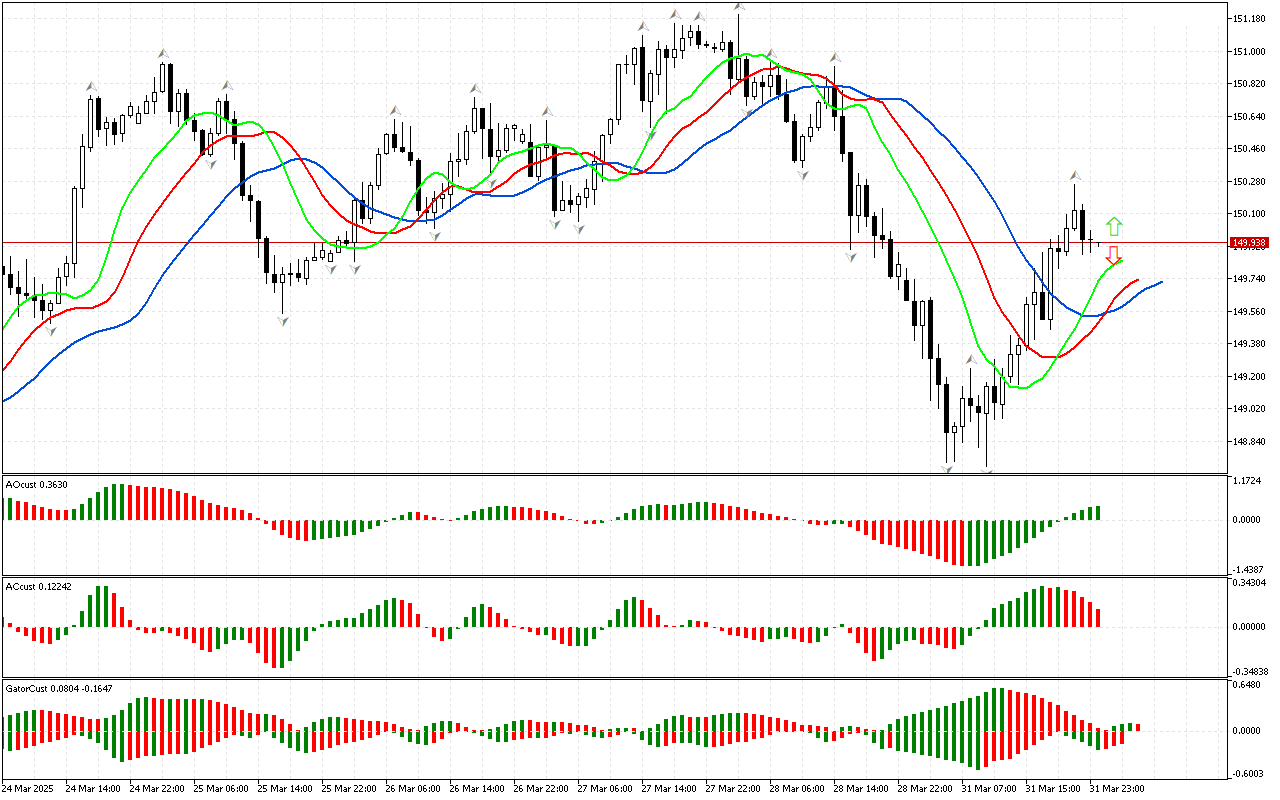

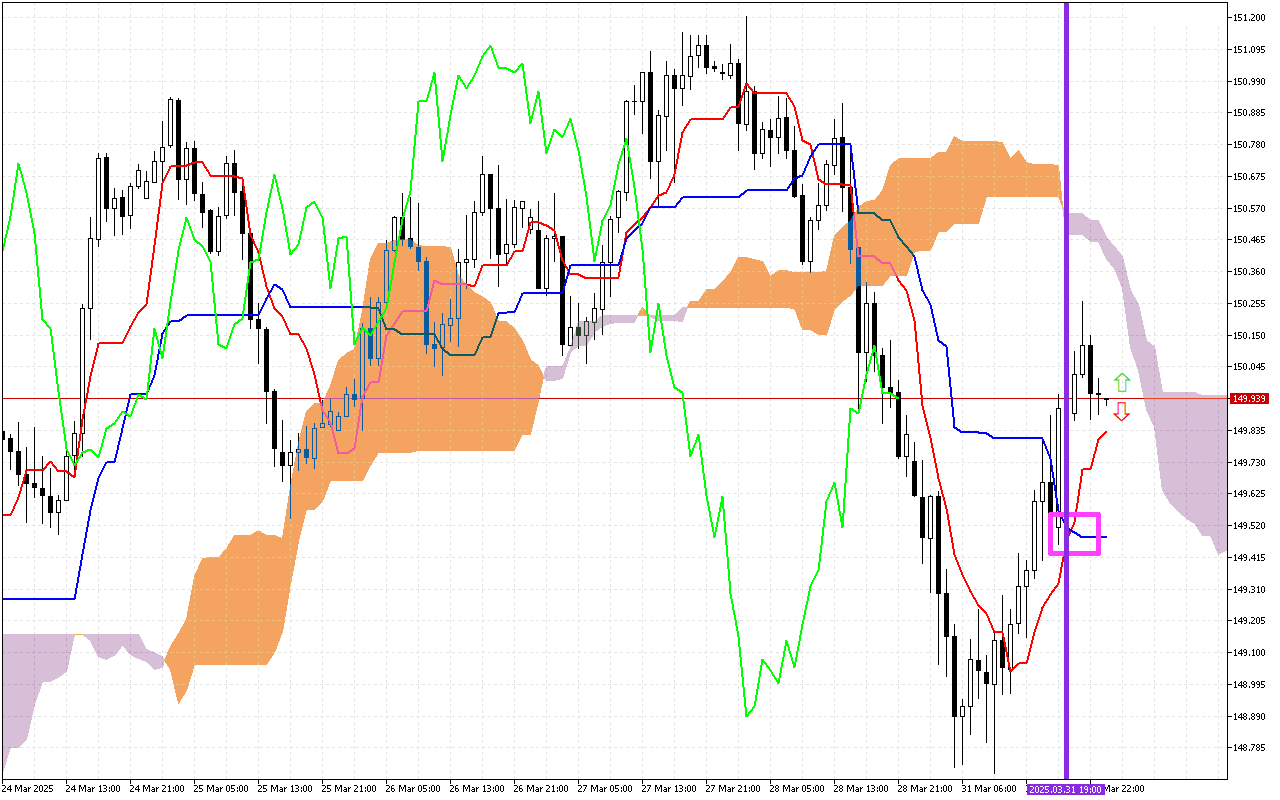

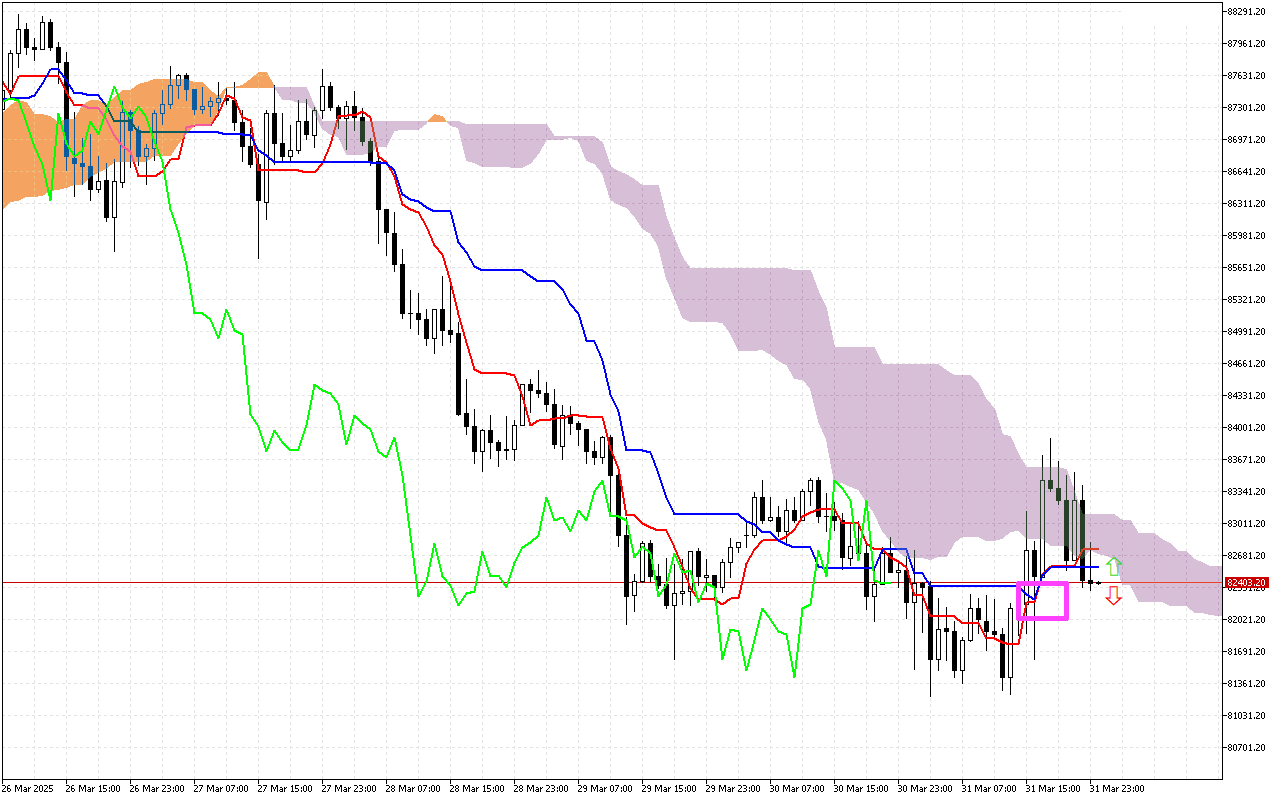

شاهد عدمقطعیت در USDJPY هستیم. قیمت از هیچ فراکتالی پایین نیامد و از هیچ فراکتالی هم بالاتر نرفت. بنابراین، نشانههای سایر اندیکاتورها را باید نادیده بگیرید. بهتر است به معاملهای...

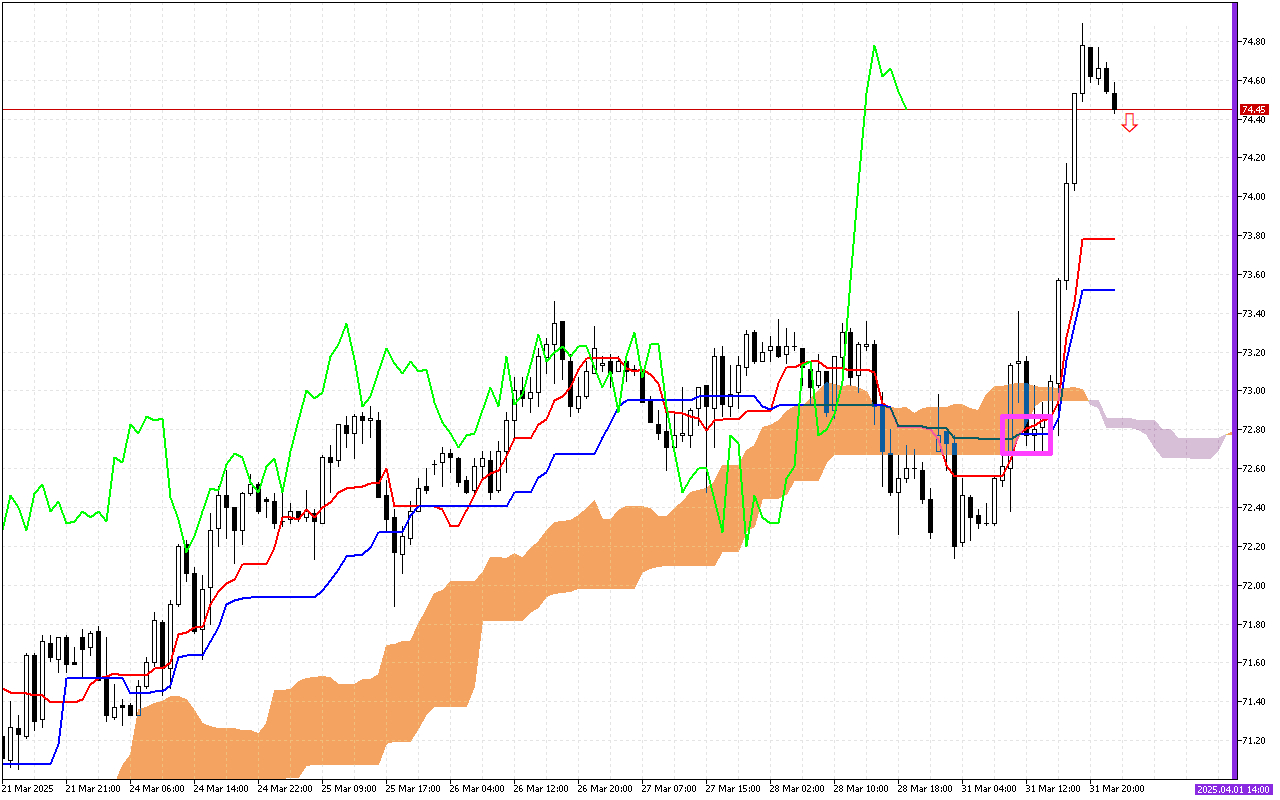

یکی از نشانههای اصلی سِشِنهای معاملاتی قبلی، کراس خطوط Tenkan و Kijun بود. این کراس با مربع صورتی روی نمودار مشخص شده است. قرارگرفتن خط Tenkan در بالاتر از Kijun...

مهمترین نشانه در سِشِنهای معاملاتی قبل، کراس خطوط Tenkan و Kijun بود که نشانۀ تغییر روند در بازار تلقی میشود.

دومین نشانۀ مهم تغییر جهت حرکت ابر Kumo است. این تغییر...

مهمترین نشانه در سِشِنهای معاملاتی قبل، کراس خطوط Tenkan و Kijun بود که نشانۀ تغییر روند در بازار تلقی میشود.

دومین نشانۀ مهم تغییر جهت حرکت ابر Kumo است. این تغییر...

مهمترین نشانه در سِشِنهای معاملاتی قبل، کراس خطوط Tenkan و Kijun بود که نشانۀ تغییر روند در بازار تلقی میشود.

دومین نشانۀ مهم، تغییر ابر Kumo از صعودی به نزولی است...

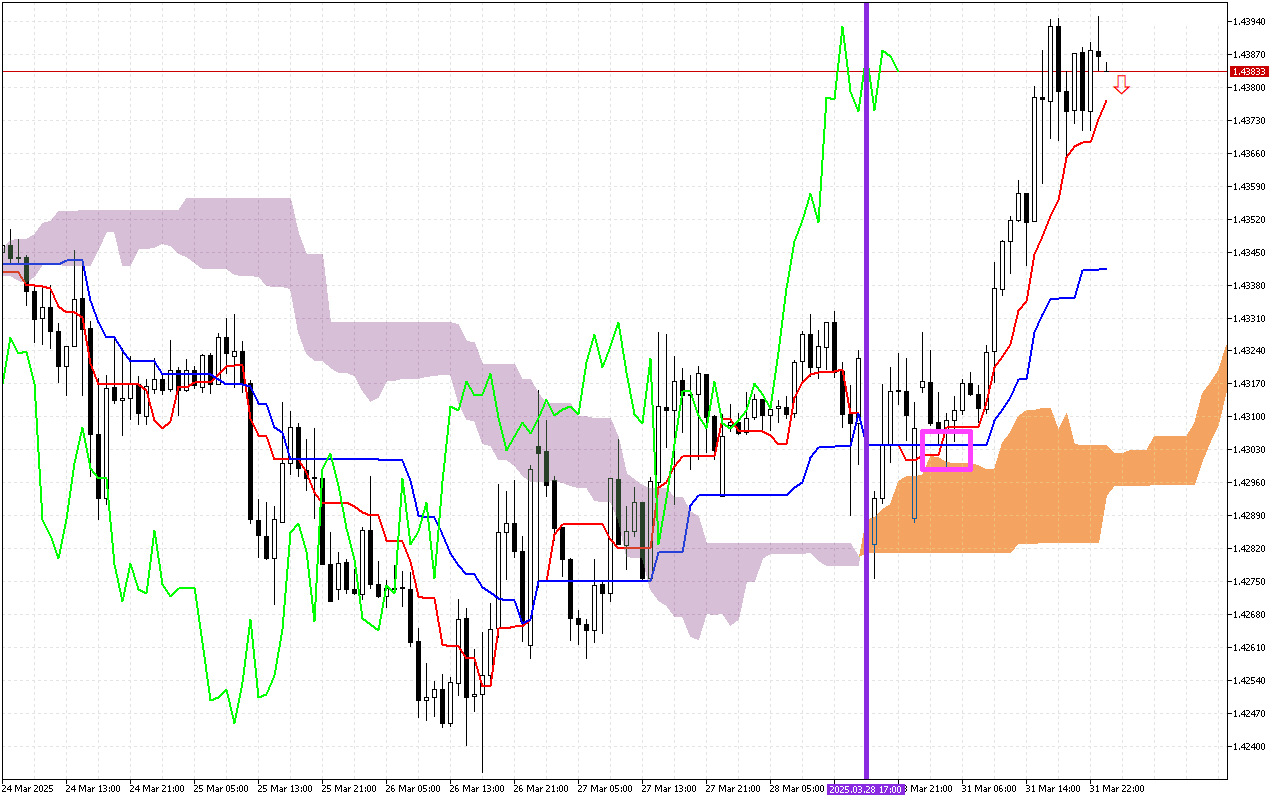

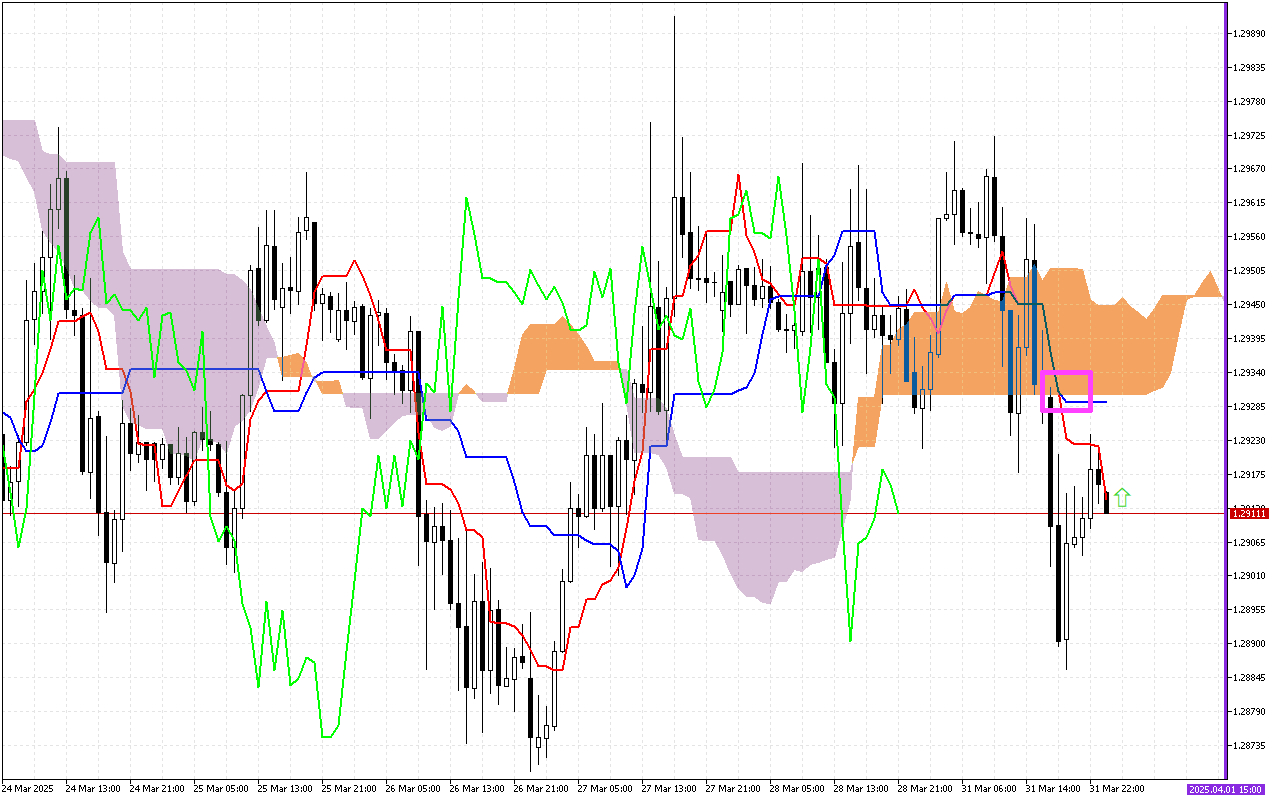

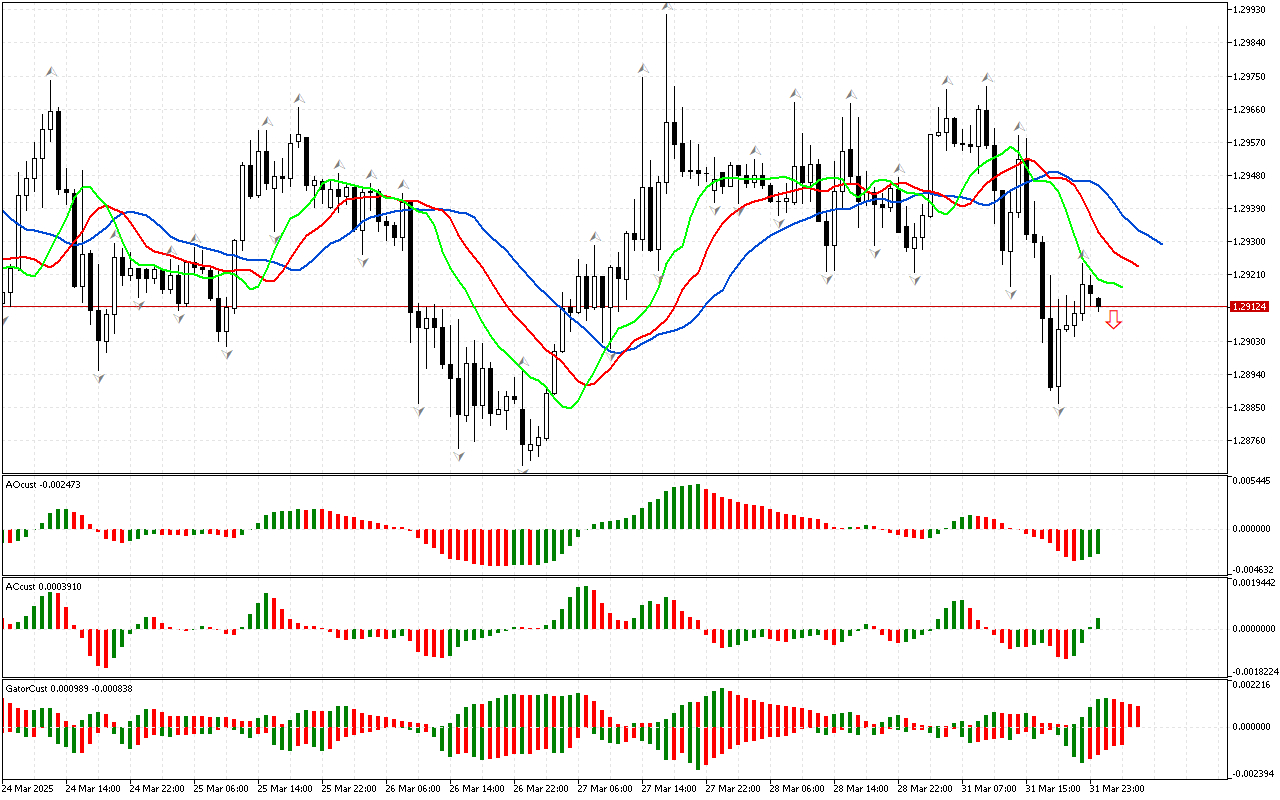

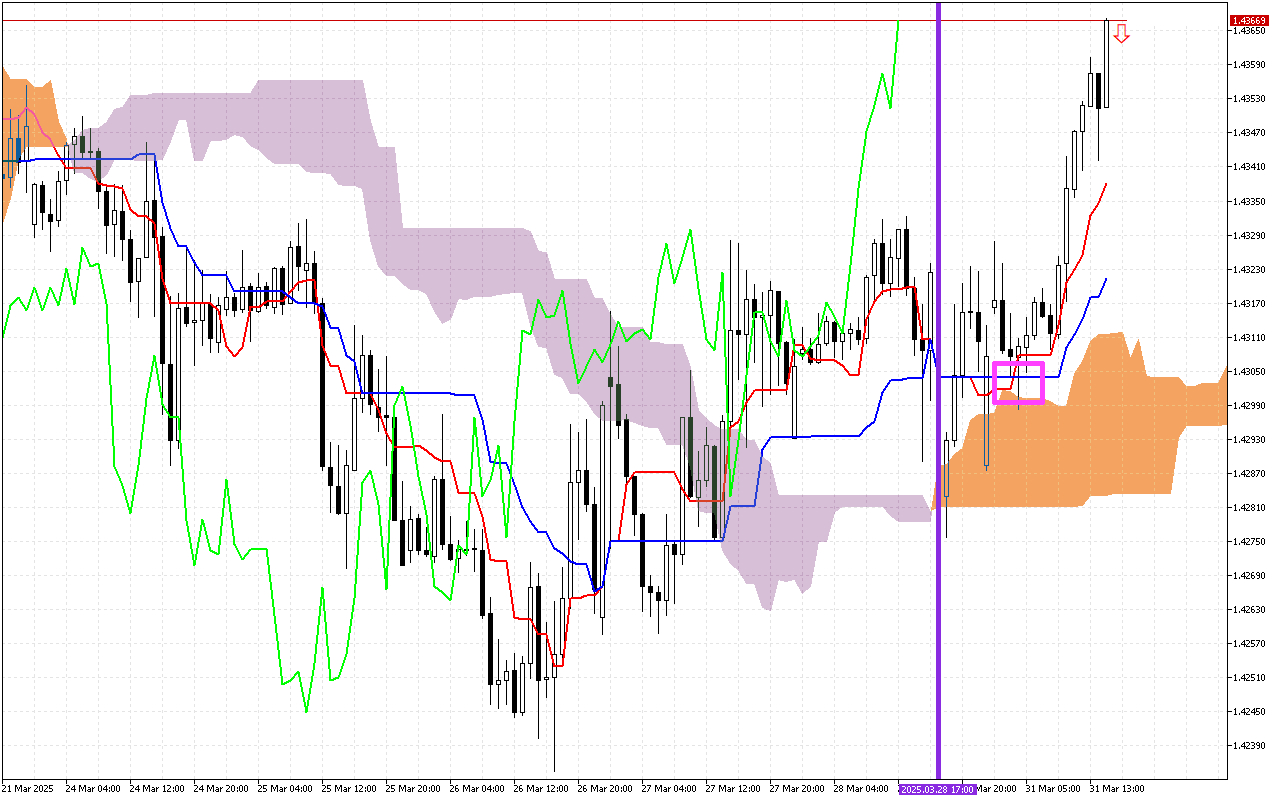

در سِشِنهای معاملاتی قبلی، در نمودار GBPUSD، کراس خطوط Tenkan و Kijun را مشاهده کردیم که با مربع صورتی مشخص شده و نشانۀ تغییر احتمالی روند صعودی به نزولی است.

دومین...

با توجه به سِشِنهای معاملاتی قبلی، توجه به کراس خطوط Tenkan و Kijun که با مربع صورتی مشخص شده، خالی از لطف نیست. خط Tenkan به زیر Kijun رفته که...

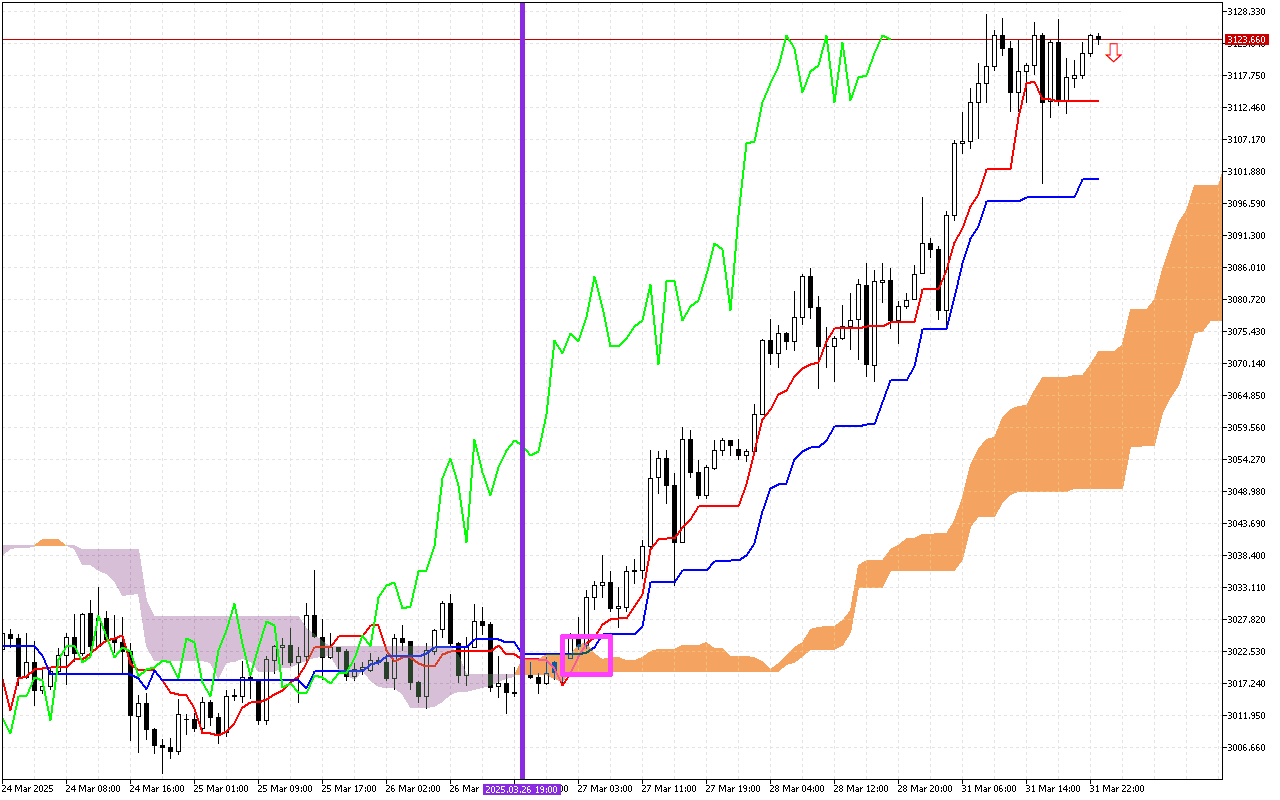

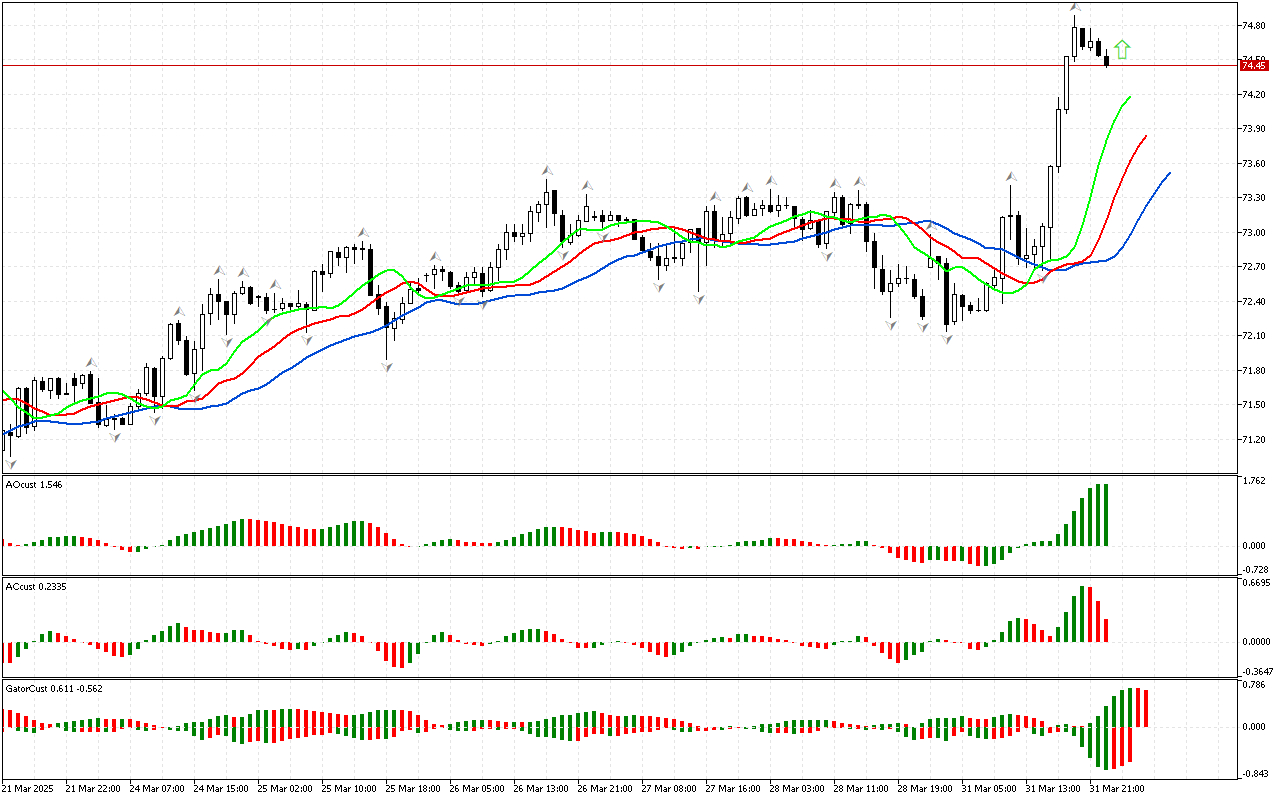

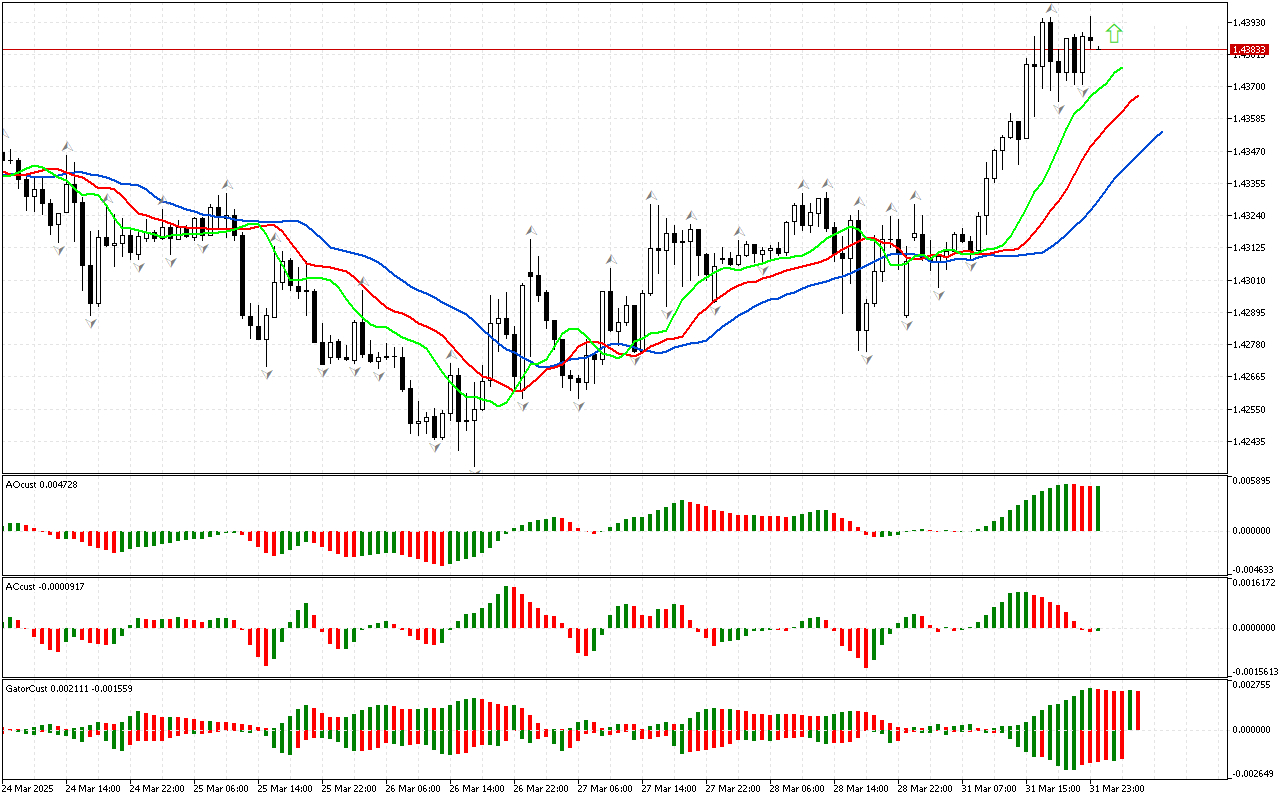

مطابق معمول، تحلیل را با بررسی بُعد اول بازار آغاز میکنیم. قیمت از فراکتال بالایی عبور کرده و در نتیجه فضای فاز صعودی است که احتمال شکلگیری حرکتی صعودی را...

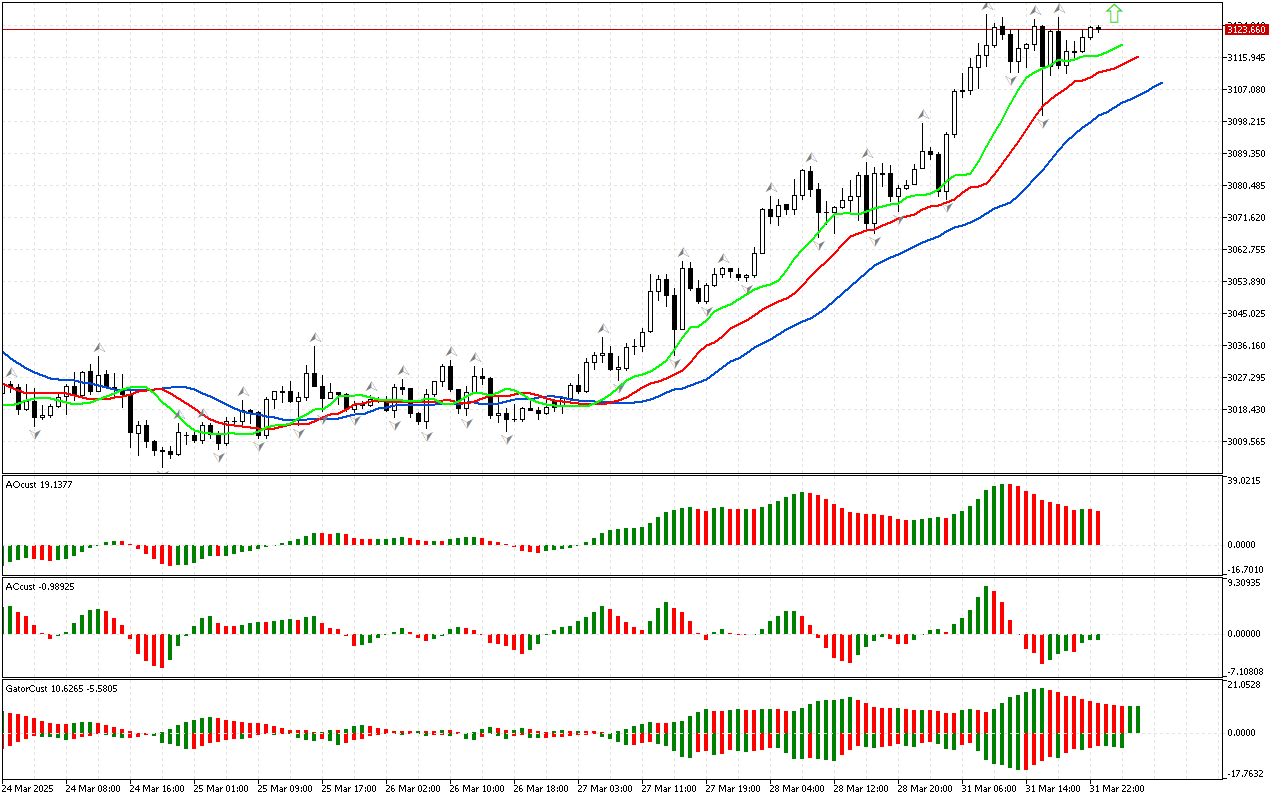

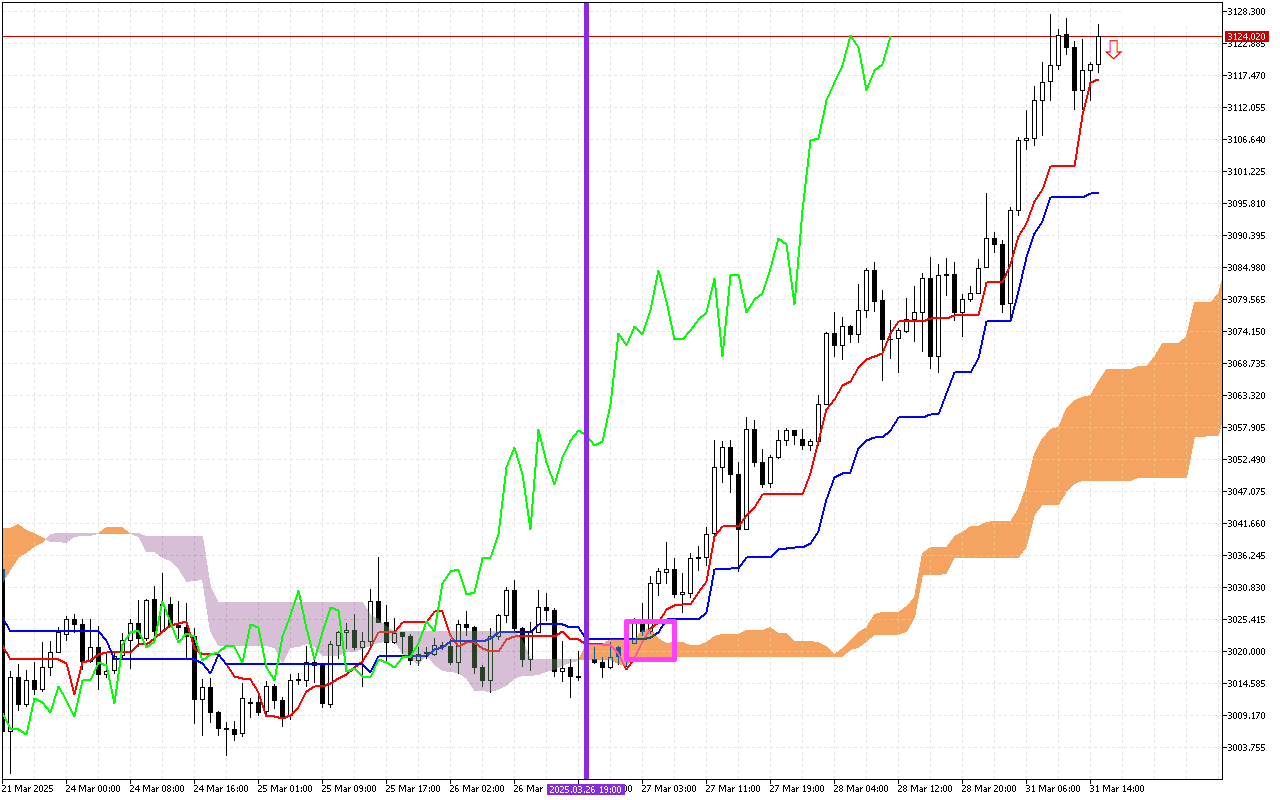

با توجه به نمودار XAUUSD، فضای فاز صعودی است، چون قیمت از فراکتال بالایی عبور کرده و اکنون میتوانیم نشانههای سایر ابعاد بازار را در چارچوب استراتژی بیل ویلیامز بررسی...

بررسی نمودار GBPUSD را مطابق معمول با تحلیل بُعد اول بازار آغاز میکنیم. قیمت به زیر فراکتال پایینی رفته و این یعنی فضای فاز نزولی است. بر این اساس، اکنون...

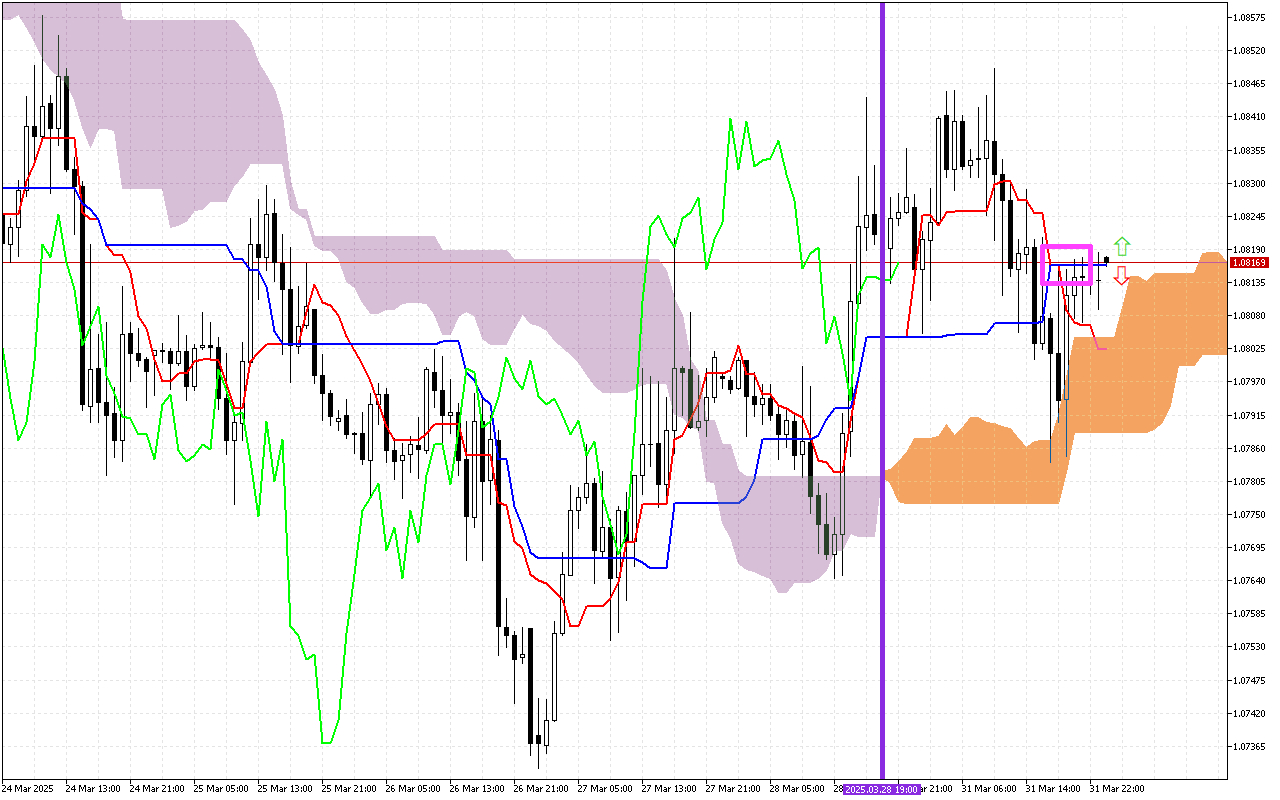

شاهد بیتصمیمی معاملهگران در EURUSD هستیم و فضای فاز نامشخص است. بنابراین، باید صبر کنید و منتظر شکست فراکتال بالا یا پایین باشید. چنین شکستی به ما نشان میدهد که...

تحلیل وضعیت بازار، که در سِشِنهای معاملاتی قبلی ایجاد شده، کراس خطوط Tenkan و Kijun را نشان میدهد. معمولاً کراس صعودی نشاندهندۀ رشد قیمت است، اما در ادامه قیمت به...

مهمترین نشانه در سِشِنهای معاملاتی قبل، کراس خطوط Tenkan و Kijun بود که نشانۀ تغییر روند در بازار تلقی میشود.

دومین نشانۀ مهم تغییر جهت حرکت ابر Kumo است. این تغییر...

مهمترین نشانه در سِشِنهای معاملاتی قبل، کراس خطوط Tenkan و Kijun بود که نشانۀ تغییر روند در بازار تلقی میشود.

دومین نشانۀ مهم تغییر جهت حرکت ابر Kumo است. این تغییر...