Changes in the trading schedule

Please note that due to the Presidents’ Day holiday in the United States on February 16, the trading schedule for several instruments will be temporarily adjusted.

Please note that due to the Presidents’ Day holiday in the United States on February 16, the trading schedule for several instruments will be temporarily adjusted.

With the New Year just around the corner, we would like to thank you for your trust and partnership with Investizo.

Please be informed that due to the Christmas and New Year holidays, the trading hours of some instruments will be adjusted.

Please note that due to the Thanksgiving holiday in the United States on November 27–28, 2025, the trading schedule for several instruments will be temporarily adjusted.

Please note that on the night of October 25–26, 2025, European countries will switch to winter time.

Please note the changes in the trading schedule due to the Labor Day holiday in the USA.

Please note that there are changes in the trading schedule due to the Independence Day celebrations in the United States.

Today, Investizo celebrates its 6th anniversary — years of growth, achievements, and the support of traders from around the world.

We are pleased to announce that Investizo LTD has been awarded Best ECN Broker Vietnam 2025 by the prestigious International Business Magazine Awards.

We would like to inform you about an adjustment to the opening time of the XAUUSD trading session due to changes from our liquidity provider.

با خوشحالی اعلام میکنیم که شرکت Investizo موفق به کسب عنوان "بهترین پلتفرم کپی تریدینگ در آسیای جنوب شرقی در سال ۲۰۲۵" از سوی World Business Outlook شده است. این افتخار بزرگ نشاندهنده تعهد ما به ارائه فناوریهای پیشرفته معاملاتی و راهکارهای کپی تریدینگ کاربرپسند، متناسب با نیازهای مشتریانمان در آسیای جنوب شرقی و سایر نقاط جهان است.

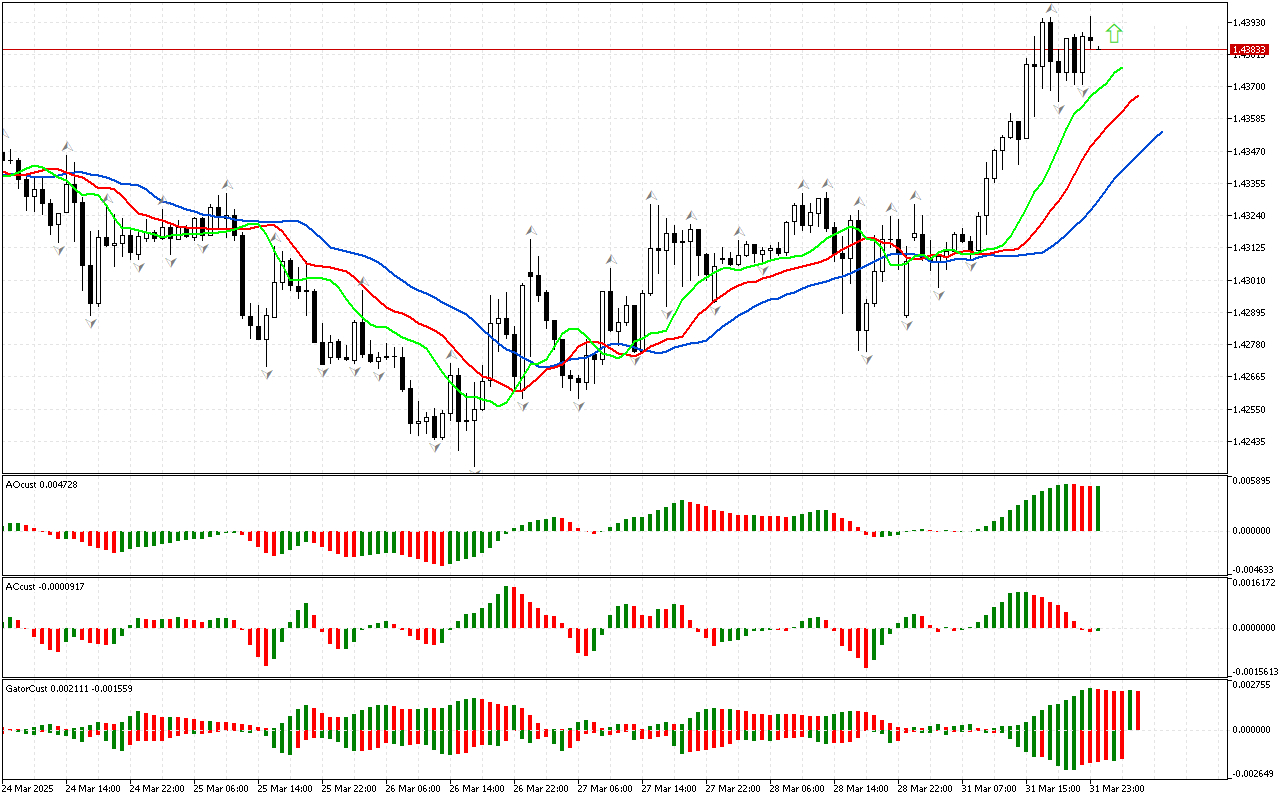

با توجه به نمودار USDCAD، فضای فاز صعودی است، چون قیمت از فراکتال بالایی عبور کرده و اکنون میتوانیم نشانههای سایر ابعاد بازار را در چارچوب استراتژی بیل ویلیامز بررسی...

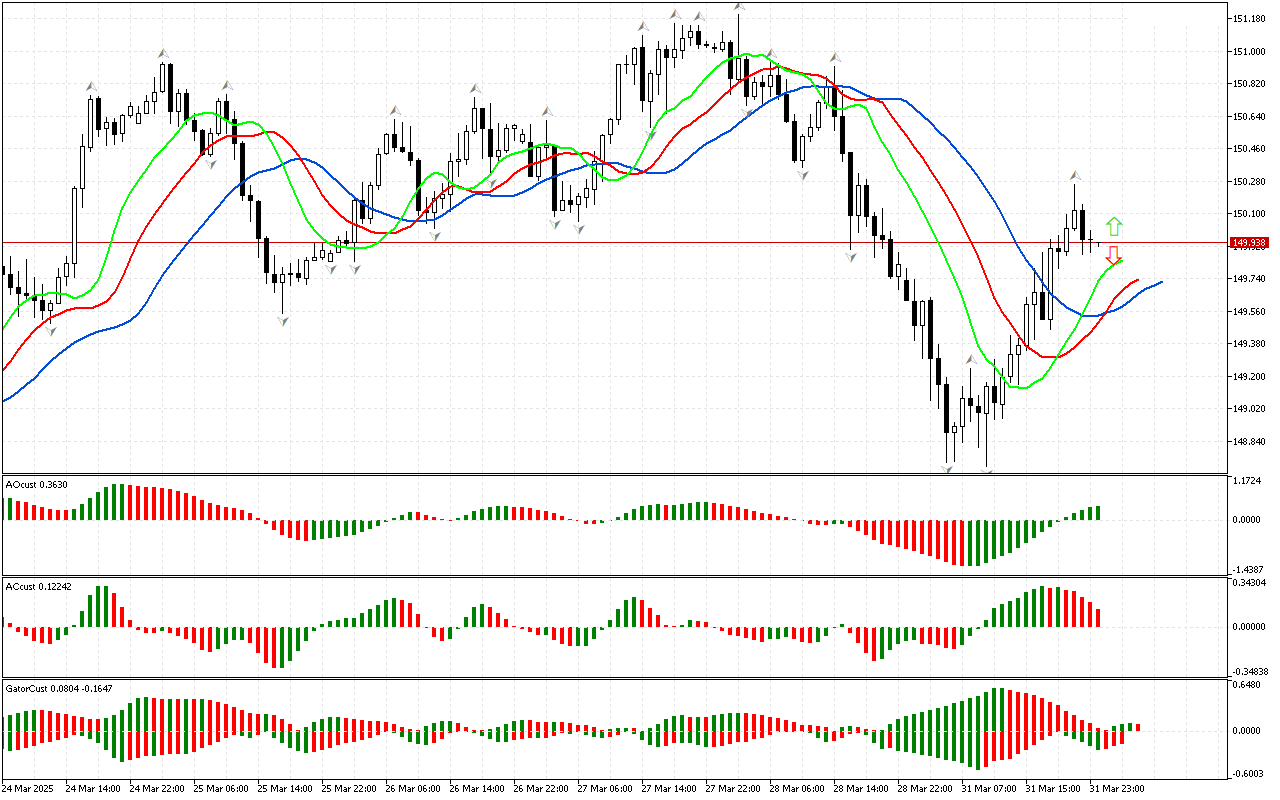

شاهد عدمقطعیت در USDJPY هستیم. قیمت از هیچ فراکتالی پایین نیامد و از هیچ فراکتالی هم بالاتر نرفت. بنابراین، نشانههای سایر اندیکاتورها را باید نادیده بگیرید. بهتر است به معاملهای...

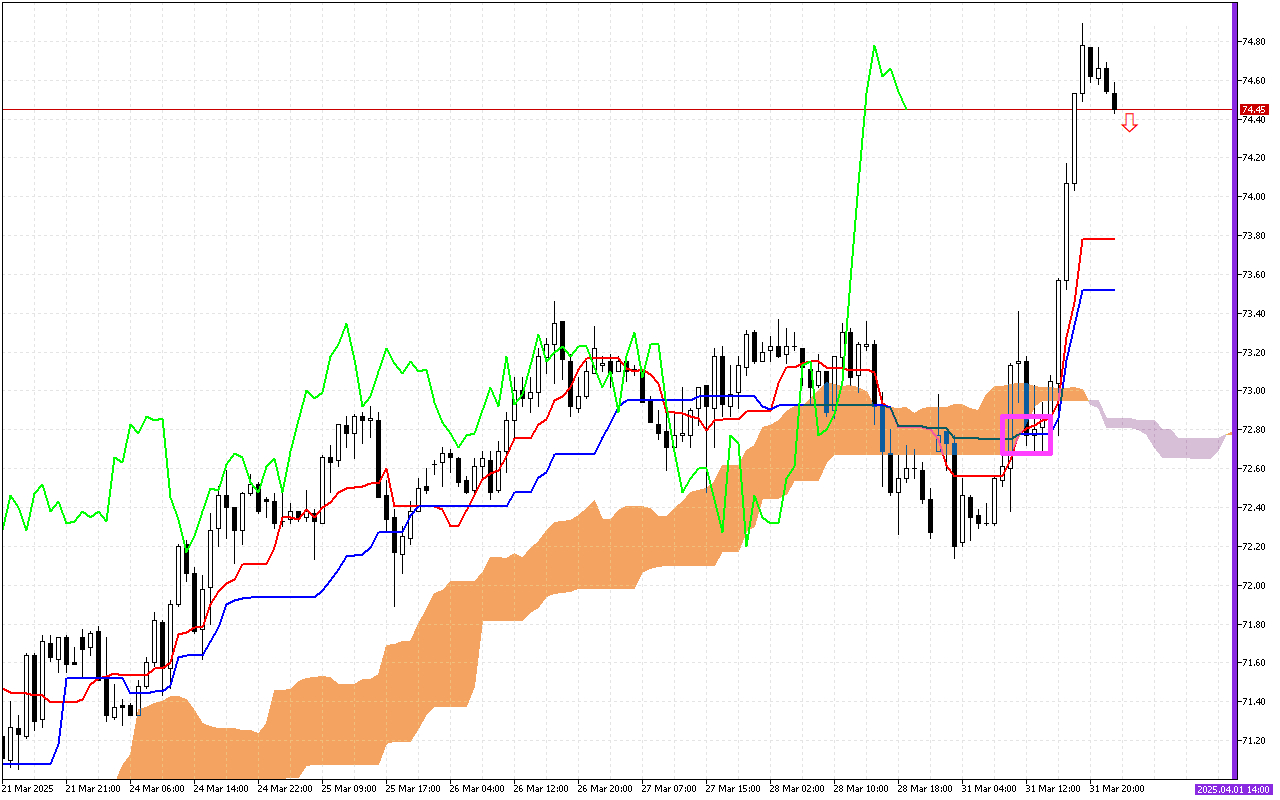

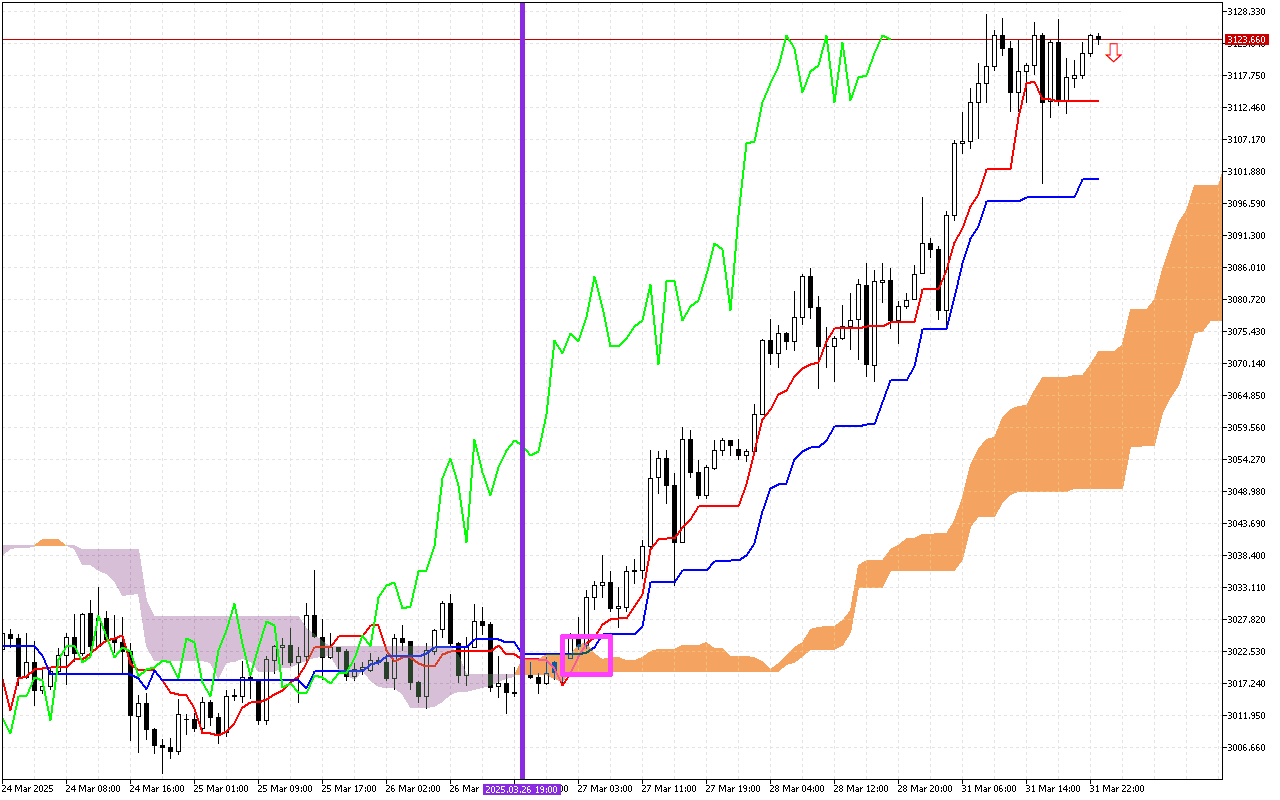

یکی از نشانههای اصلی سِشِنهای معاملاتی قبلی، کراس خطوط Tenkan و Kijun بود. این کراس با مربع صورتی روی نمودار مشخص شده است. قرارگرفتن خط Tenkan در بالاتر از Kijun...

مهمترین نشانه در سِشِنهای معاملاتی قبل، کراس خطوط Tenkan و Kijun بود که نشانۀ تغییر روند در بازار تلقی میشود.

دومین نشانۀ مهم تغییر جهت حرکت ابر Kumo است. این تغییر...