USDJPY H1: The Chaos Theory Forecast for the American Session on 29.1.2025

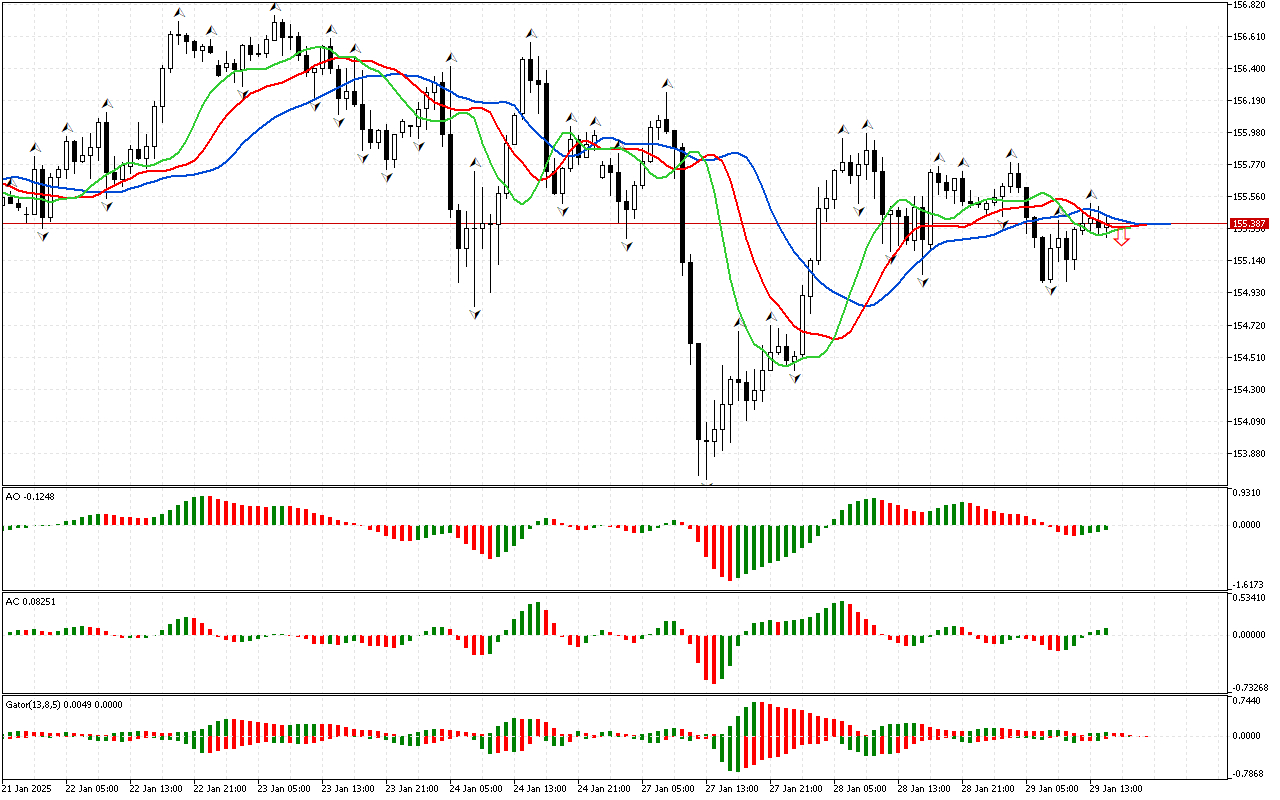

The Alligator confirms the signal of the first phase of the market: its mouth is open.

The Awesome Oscillator indicator has consolidated below the zero mark.

The green bars have been formed above the green line on the Accelerator Oscillator indicator. It signals either a correction or a trend movement change. It indicates the market's losing energy to continue moving in southern direction. However, as long as the price remains below the Alligator’s red line, the southern movement remains prevalent.

The last bars on the AC and AO charts are green. The indicators signal that the strength and energy of the southern impulse are experiencing a deceleration. It can be either a reversal of the local trend or a signal about the development of a correction. However, while the price is below the Alligator indicator, the movement in the southern direction remains prevalent.

The histogram of the Gator indicator has not formed a clear signal yet. The color of the histograms changes, indicating a change in market phase.

As an epilogue to the analysis, the southern direction of price movement is noted to be considered as a priority. At the same time, the indicators contain signals about the possible development of a correction, which should be used to search for entry points at more beneficial prices.

📊 Sell Stop 154.997

❌ Stop Loss 155.512

After entering the market, Stop Loss is moved along the red line after closing each candle. The profit is fixed by moving Stop Loss, or when opposite signals appear on the AO, AC, Gator indicators.